Identity and Onboarding Solutions for

Financial Services

Today's customers hold high expectations for their digital experiences, requiring both speed and ease-of-use.

At IDmission, we boast a global footprint of financial services companies improving customer experience, ensuring regulatory compliance and enhancing operational efficiency with our full suite of identity verification, ID authentication, and onboarding solutions.

Get customer service right by giving your customers the convenience they expect without sacrificing security.

Banks, insurance providers, cryptocurrency companies, and other financial services rely on IDmission.

AI-Powered Banking and Finance Authentication Solutions

IDmission has a global footprint of financial service companies utilizing our full suite of identity verification, ID authentication, and onboarding solutions. Banks, insurance companies, cryptocurrency providers, and many other financial service companies rely on IDmission for AI-powered technology integrated into a seamless onboarding application.

Whether you have an existing application or need our expertise to provide an onboarding solution, IDmission’s team of scientists, engineers, and solution specialists are here to assist you in making your customer’s online journey successful.

Banking Solutions

Banking Applications

Customers use IDmission technology to solve many finance industry solutions including:

- Digital Account Opening (Self Service)

- Digital Account Opening (Assisted by Agent)

- Branchless Banking

- Loan Originations

Banking and Finance Features

Our solutions provide many different features depending on your specific application:

- ID capture, Automatic OCR, Barcode reading, Selfie capture (with Liveness detection), automatic match Selfie to ID photo

- Biometric deduplication ensures one person is only one customer

- Workflow management and case management

- Data verification against 3rd party systems (See IDmission Junctions)

- Data delivered automatically to the core banking system

Biometric Identity Verification

Verify biometric identity of enrolled customers for:

- Account updates

- Wire transfer initiation

- High value transactions

Money Transfer/Check Cashing/Cryptocurrency Solutions

The largest money transfer company in the world relies on IDmission’s document and identity verification solutions. Our AI and biometric engines are used 24/7 to execute millions of money transfers every year. If you require the best authentication of your consumers, IDmission can help you in over 160 countries around the globe. Our database of documents supported is not just a number, we update over 4000 documents every single month and these documents constantly feed our machine learning tools to ensure we are providing the most comprehensive solution on the market.

Lending Solutions

IDmission helps solve the issues with remote lending, origination, and closing. Our applications can automate your processes and significantly improve your identity process with added KYC capabilities as well as ensuring there are no issues with agent or customer fraud.

Insurance / Pensions Solutions

Manage your insurance accounts with digital policy purchases, payments, claims management, customer onboarding, and account management. IDmission offers the following insurance and pension solutions:

- KYC: ID capture, automatic OCR, barcode reading, selfie capture (with liveness detection), and automatic match: selfie to ID photo.

- Can be used by agents or in self-service

- Other biometrics – fingerprint, face, voice, iris

- Biometric deduplication ensuring one person is only one customer

- Biometric verification for repeat customers

- Workflow management and case management

- Data verification against 3rd party systems (IDmission Junctions)

- Data delivered automatically to your core data systems

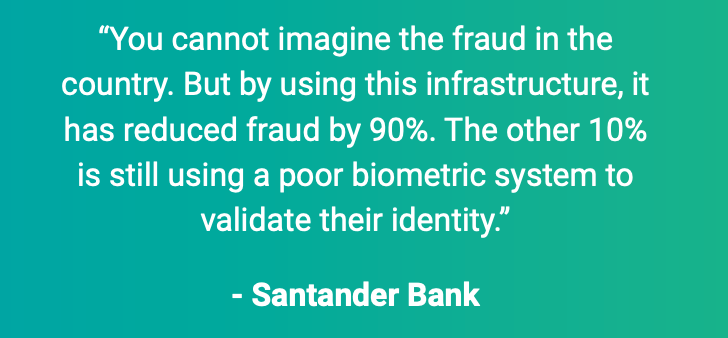

CASE STUDY: Global Bank Decreased Fraud by 90% After Using IDmission Biometric Technology

After engaging IDmission to implement its advanced biometric technology in 2018, Santander bank began to see an immediate decline in fraudulent activity despite the increased enrollment and activity in client pension accounts.

Our Financial Customers

Contact Us Today

We love helping customers solve problems and we are easy to do business with, try us out

+1 (800) 925-8041 Ext. 2

+1 (800) 925-8041 Ext. 2 sales@idmission.com

sales@idmission.com