Advanced Technology for Identity Verification

Stay Compliant. Reduce Risk. Add Convenience.

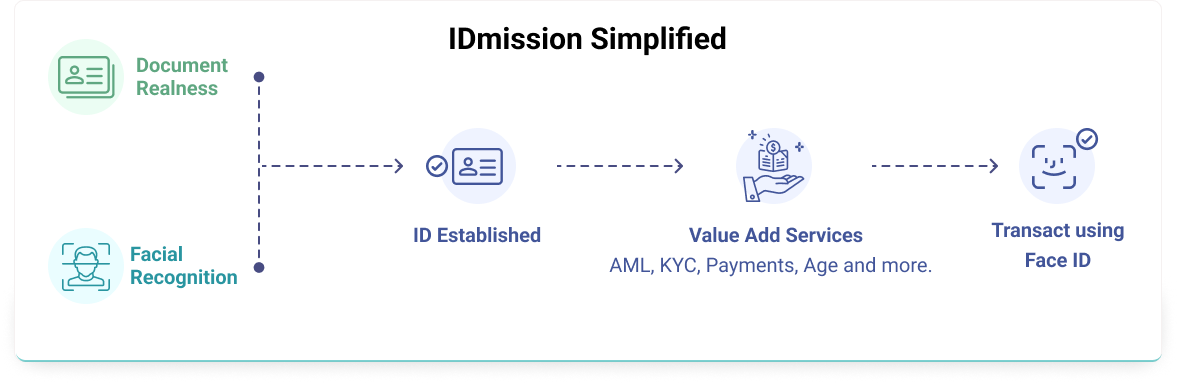

Recognize customers using a selfie, capture documents, check background and transact, all in seconds.

Quickly build advanced identity into your applications, using our mobile & web SDKs, APIs or Identity-as-a-Service.

Technology to Capture Digital Identity

Envision proving your identity once, then using a selfie to unlock everything in your digital life. IDmission can help make it happen.

IDmission technology components enable you to select specific steps in the ID verification process, or to create your entire digital identity solution.

200

Countries covered. Deep expertise in LatAm documents.

$0

No minimum monthly fee, pay only for what you use.

5 Million

Records train our Machine Learning.

300M

Identities processed

_

.png)

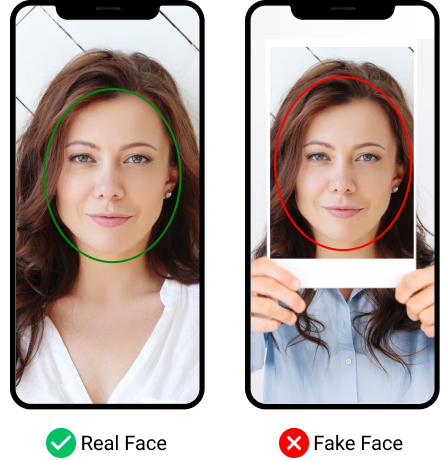

Liveness

- Person – is this “person” a human being and not a statue, mask, face bust, or virtual persona posing as a person?

- Physically Present – is this person authenticating themselves in real time and not using a photo, video, deepfake, or replay attack?

- Precisely who they say they are – is this person who they claim to be and do they have the right to access the information, account, or service requested?

-1-1.png)

Document Realness

-

True presence of the physical ID document – is the ID document physically present?

-

Tamper-free text on ID document – is the text on the ID document manipulated, replaced, or tampered with?

-

Tamper-free photo on ID document – is the face region on the ID document manipulated, replaced, or tampered with?

Trusted By

We're a truly global company, rooted in the US.

From our humble beginnings, we've worked hard to establish ourselves as an identity software provider around the world. We know that the more diverse data we feed our AI, the better it will be.

This helps us to achieve our mission of making identity accessible not just to developed countries, but to the developing world as well. By making identity accessible to all, we are one step closer to allowing financial inclusion, growth and technological advancement across the globe.

Learn more about IDmission

Certificates and Compliance

Contact Us Today

We love helping customers solve problems and we are easy to do business with, try us out

+1 (800) 925-8041 Ext. 2

+1 (800) 925-8041 Ext. 2 sales@idmission.com

sales@idmission.com